#1 Outsourced Accounting, Tax, and Bookkeeping Firm

For the most part, these services are identical to outsourced accounting services, although it’s important to bear in mind that different providers will offer varying services. Opt for full-service accounting if you’re looking for a complete solution that manages all your accounting https://www.personal-accounting.org/25-best-accounting-firms-for-2023/ tasks. This service includes everything from routine bookkeeping to complex tax planning and payroll management. It’s an ideal choice if you don’t have the resources for an in-house accounting team. No one knows the challenges of managing your company’s finances better than you.

Virtual accounting FAQ

On the other hand, Outsourced accounting allows you to work with companies usually equipped with cloud-based systems and automation capabilities and can offer you consistent services. Outsourcing these responsibilities to a financial expert familiar with accounting systems can allow you to devote more time to business development and other significant tasks. Headquartered in Nevada, MedVa was founded by doctors to optimize patient care and healthcare management. It offers virtual assistants with expertise in the medical and dental fields to assist doctors with their appointments, scheduling, billing, and more.

- Our technology can automate and integrate your transaction workflow, giving you real-time visibility into your business and freeing you to concentrate on your core competencies.

- In doing that, your outsourced accounting firm will work closely with you to develop an approach that works for your business.

- With outsourced accounting services, you also get flexibility in adjusting the level of service to meet the seasonal needs of your business.

- If you have a Certified Public Accountant (CPA), we can handle your monthly bookkeeping and then send your financials and tax prep info to your CPA at year-end.

- These kinds of steps can give you peace of mind and help ensure you avoid any costly slip-ups.

Outsource Access

Yes, virtual and outsourced bookkeeping is just as legitimate as in-house bookkeeping and accounting. However, as with any in-person accounting professionals you’d trust with your financial data, you should always verify a bookkeeping firm’s credentials before committing to a monthly plan. But there’s more than one virtual accounting company in the world, and solutions range from on-demand CFO services to simple pay-by-the-hour book balancing. Below, we review the best virtual and outsourced accounting services for small-business owners like you. For over 15 years, we’ve been pioneers in the field, leading the charge in outsourced accounting, tax, audit, and bookkeeping services for small and medium-sized businesses.

printable time sheets you can download (free templates)

These services range from comprehensive solutions like full-service from accounting firms to more focused assistance such as fractional CFO services. Each type of service offers unique benefits, allowing you to customize your financial management strategy as your business grows and evolves. Opting for outsourced finance and accounting services is an increasingly popular solution among business owners and growing startups. It offers a path to tap into specialized expertise, enabling you to easily handle your financial operations with precision and compliance in mind. Complimentary ProposalTo take a test run of our outsourced accounting services, we offer you a free, no-obligation proposal.

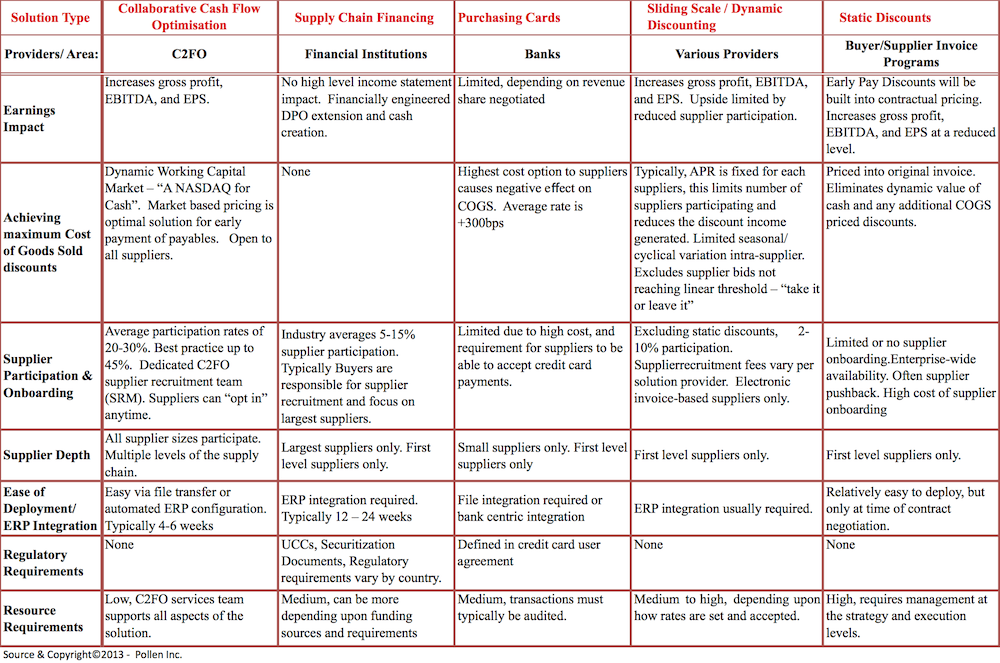

Outsourcing In Finance And Accounting

Live ChatMonitoring is a BPO company with headquarters in Australia that offers 24/7 live chat support to companies of all kinds, from software development to consumer products. These outsourced teams usually consist of skilled professionals with the right equipment to expertly handle your work https://www.personal-accounting.org/ from the get-go. As you outsource these non-core activities, your in-house employee will have more time and resources to spend on the activities that you actually specialize in. Outsourcing is the process where a business delegates certain non-core business process activities to a third party.

To begin with, list what services you require from an outsourcing partner. With so many options, picking the right outsourcing company for your needs can be very tricky. When your business grows, there are tons of additional costs you’ll have to take care of. The third party can be dedicated outsourcing companies from your home (onshoring), a foreign country (offshoring), or individual freelancers. Outsourcing tax prep internationally has been commonpractice for many years, but many misconceptions remain. Provide clients with much-needed tax guidance, be more proactive throughout the year and save critical time with a simplified, frictionless end-to-end client experience.

If you do decide to pay a third party to handle your accounting, be aware of the potential for scope creep. You’ll want to set clear expectations from the start about the scope of work, not to mention how to handle any tasks outside of that scope, especially if you’re paying hourly. An early and open discussion about this can keep you from being hit with unexpected costs down the line.

Additional costs or fees may be incurred for additional services throughout the duration of service. They spend hours doing tutorials, chatting with support representatives, or double-checking their numbers. And every hour spent learning or managing accounting software is an hour not spent on generating revenue directly.

By keeping these considerations in mind, you’ll be able to avoid any of the drawbacks that can impact businesses that partner with an outsourced CFO that isn’t a great fit for their business. It’s easy to think that the CFO role is a position what are the importance of ifrs reserved for larger companies, but that doesn’t have to be the case. Many small to midsize businesses stand to benefit significantly from working with a CFO but tend to lack the resources to hire these experienced professionals.

Finance and accounting outsourcing is only the beginning—RSM has the people, processes and technology to transform your finance department and, by extension, your company. We understand your need for specific accounting personnel as your business grows, but local hiring might not be a cost-effective strategy. We provide bilingual talent at a cost that enables savings and future reinvestments.

Let’s chat and discover how PABS can be the perfect fit for your business. In addition, RSM has a dedicated technology team that supports FAO resources to increase education, and we deploy emerging innovations to improve our outsourcing platform. In this way, RSM FAO enables more timely, actionable information to guide decision-making.

Chief Financial Officers (CFOs) provide invaluable leadership in businesses all around the world. Their job is to head up a business’s financial strategy, designing and implementing financial systems and processes that enable the business to operate more efficiently. Outsourced controllers also bring a tried and tested approach to helping manage your business’s finances. That know-how gives them the ability to build your business a financial infrastructure that’s resilient to all kinds of challenges. With the right partner, it’s possible to mitigate these downsides entirely, but to do that, you need to be aware of what to be on the lookout for.

RSM’s FAO technology is scalable, accessible through the cloud and provides real-time, automated reporting. We work with leading technology partners such as Oracle NetSuite, Sage Intacct, Intuit QuickBooks, Blackline, Tallie and Bill.com. Platforms are regularly upgraded without affecting functionality and as improved technology becomes available, we enhance platform offerings as appropriate, so it’s always up to date. For years companies have outsourced their legal, advertising, printing and computer services so they benefit from professional expertise without substantially increasing overhead. Learn about accounting firm management styles and apply frameworks and methodologies like Scrum, Kanban, and Agile to your day-to-day accounting operations.

With 15,000+ articles, and 2,500+ firms, the platform covers all major outsourcing destinations, including the Philippines, India, Colombia, and others. Above all, find an outsourced CFO that you can build a long-term relationship with. An outsourced CFO should be a trusted strategic partner with whom you work intimately – not just another vendor. Listen to your intuition and find an outsourced CFO you know you can trust. These tasks are more strategic in nature than the work typically performed by bookkeepers. The entities falling under the Cherry Bekaert brand are independently owned and are not liable for the services provided by any other entity providing services under the Cherry Bekaert brand.