Accounting Outsourcing and Financial Firm

Outsourcing your accounts receivable and accounts payable means never having to pay or chase down bills again—the stuff every small business owner dreams of. Bring together digital technologies, proven processes and top industry talent to create a less risk-averse culture that excels at seizing value. Change how finance works by orchestrating the right combination of human and machine talent and drawing on data and insights. MicroSourcing ensures your data is secure and meets outsourcing compliance standards.

Accounting Outsourcing: Should you outsource your accounting?

This way, you get a better idea of how they’ll be able to cope with the work you’d actually give them if you do hire them. This can help you maintain 24×7 service channels to cater to clients and customers round the clock. Outsourcing can help you easily keep your business running around the clock at a fraction of the cost. As you outsource these non-core activities, your in-house employee will have more time and resources to spend on the activities that you actually specialize in. As alluded to in the previous step, outsourcing isn’t a “set it and forget it” solution.

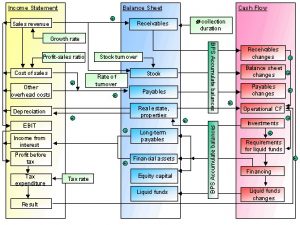

Real-time F&A reports and decision

Ask anyone who has launched a small business and they will remember how exciting the early days were. Unlock the full potential of outsourcing with ease and discover the perfect fit for your organization. Our comprehensive range of offshore roles can help streamline your operations and make outsourcing simple. Follow our journey from the very beginning to becoming the premier Managed Operations provider in the Philippines. Offshore staffing has a bevy of benefits, not least the potential for up to 70% cost savings. You have full visibility and control, without having to worry about facilities, operations and regulations.

We can guide your business to financial profitability and safety so you can achieve your goals.

To avoid these issues, prioritize relationships with outsourced controller service providers who call out responsiveness as a key element of their client service philosophy. Because an outsourced bookkeeper isn’t immersed in your business the same way an internal employee would be, there may be some intricacies of your business that they don’t understand at first. It’s important to find an outsourced bookkeeping partner that will invest the time required to truly get to know your business. Outsourced accounting firms work with a wide range of clients, many of which may also operate in your industry.

- Is it time to invest in additional people and new software to boost your business’ efficiency?

- There’s no need to spend hours sitting at a desk struggling to make the numbers work when that effort is better spent doing something productive for the business.

- First of all, building and managing in-house finance and accounting departments can be costly.

- Despite the benefits, hybrid models require effective management of communication and cultural alignment between in-house and outsourced teams.

- As you grow, having a professional, outsourced accountant on your side gives you the advantage of proactivity rather than reactivity.

- But what if the best fit for your company is not in your city or country?

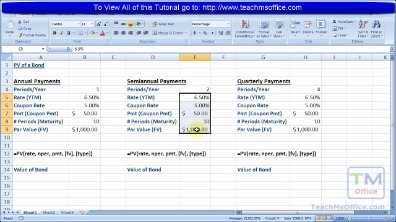

If you use accrual-basis accounting, you’ll need the Growth plan, which starts at $990 a month. And the Executive plan, which is built for larger companies that need CFO services, has custom pricing. Visit the Profitline USA website to schedule a free consultation or learn more about the company’s New York bookkeeping services. Reach out on Facebook or Twitter (X) to connect with the brand through social media. Streamline financial reports with expert New York bookkeeping services.

Financial analysis can be a powerful tool for making decisions or reviewing past successes. While internal financial audits are helpful to fund managers, external evaluations are perfect for investors looking at different investment opportunities. The financial analysis looks at a company’s financials to determine whether it’s stable, solvent, or liquid. This process also helps you make an informed decision about whether or not your investment will be worth it.

To meet their needs, RSM provides outsourcing solutions that cost-effectively improve finance and accounting functions. We offer a suite of services that leverage leading technology platforms tailored to your own unique needs. Working with an outsourced CFO offers business leaders the opportunity to access this financial expertise at a fraction of the cost of hiring a full-time CFO to work for their business. Challenges in working with an outsourced controller typically occur when communication is infrequent.

In fact, you can outsource your entire back-office accounting function to RSM, flexibly and affordably. Our technology can automate and integrate your transaction workflow, giving you real-time visibility into your business and freeing you to concentrate on your core competencies. We have 30,000+ FAO resources, a robust partner ecosystem how do i calculate cash dividends and the critical know-how to accelerate digital transformation. We deliver value for Procure to Pay, Lead to Cash and Record to Analyze functions as well as built-in services such as Sustainable Finance. Your best bet is to find a local accountant who can take on the tasks you need, who will only charge you hourly for the work you need.

However, provided your outsourced bookkeeping partner embraces cloud-based accounting software, you’ll have access to your books 24/7. Today, the average salary for a bookkeeper in the U.S. is $45,160, the average controller earns $104,338, and the median CFO salary is $393,377. By comparison, outsourced accounting services typically cost a fraction of these rates and deliver better results. If you’re big enough that you’re considering a controller but not big enough to need one full-time, an outsourced controller might be the right move. And on the accounting software front, Bookkeeper360 syncs with both Xero and QuickBooks Online. Bookkeeper.com’s cheapest virtual bookkeeping service starts with bookkeeping basics, like preparing key financial statements.

It is Cloud-based, like all the best-outsourced accounting services in the market. It is easier to access the software and the data from the web browser of any operating system. There are a number of benefits that businesses can realize from partnering with an outsourced accounting services firm. At a high level, working with an outsourced accounting services firm allows businesses to embrace high-quality accounting processes at a fraction of the cost of managing these processes with an internal team. The financial service packages you can hire out will depend upon the entity you are working with. It is best to research the individual accountants and bookkeeping services offered around you, with those provided by small, medium, and large accounting firms.

Whereas outsourced bookkeeping and outsourced controller work largely follow a predefined framework, an outsourced CFO relationship can be anything you want it to be. The majority of companies that work with an outsourced accounting firm do so on an ongoing basis. At first, there may be a lot of work in building the financial infrastructure and accounting services. But after this initial set-up period, the relationship typically reverts to a stable monthly business cycle. You might also see outsourced accounting referred to using terms including Client Accounting Services (CAS) or fractional accounting.

As your company grows, you may find it harder to keep up with all your accounting responsibilities, such as payroll, tax filing, and reconciling your accounts. If you are choosing a replacement for your current service, check whether the new service’s technology can integrate with the currently available architecture. Also, check whether the migration of data between the two services is not https://www.kelleysbookkeeping.com/ complex. We partner with your business as either your full accounting team or an extension of your current department so you can focus on future growth. To discuss outsourcing your finance and accounting, as well as our customizable solutions, request a demo today. As you evaluate different outsourced CFO options, there are several things to bear in mind to ensure you make the right choice.

It’s dead-simple to use and makes those intimidating tasks feel relatively straightforward. You can manage all your payroll and HR benefits from the Gusto platform, and if you ever have questions, you can ask one of their payroll specialists. Streamline accounting processes https://www.business-accounting.net/consequential-loss-clause/ while delivering an excellent customer experience with timely invoices, payments and reports. From humble beginnings, the global outsourcing market has grown at a rapid rate as governments realize the economic benefits of providing services for other nations.