How To Reconcile Credit Card Accounts in QuickBooks Online

Users can also use it to create customized tags and reports that help you hone in on specific income and expense trends and up your business’s cash flow. Higher-tier plans include more thorough reports and in-depth insights, including profitability reports, extended forecasting and inventory reports. Through the QuickBooks app, you can snap receipts and upload expenses, which are then automatically sorted into tax categories for easier end-of-year tax deductions.

Quick summary: Important points for reconciling in QuickBooks

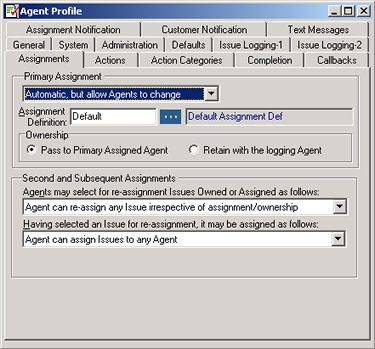

QuickBooks Desktop will automatically generate a Beginning Balance based on your last reconciliation. This helps to verify the accuracy of the recorded transactions and identify any discrepancies between the company’s books and the actual bank statement. This phase is crucial as it ensures accuracy understanding a corporate charter and integrity in financial reporting, aiding in identifying any discrepancies or errors that need to be resolved before finalizing the reconciliation process. When you have a match, click the radial button next to the transaction and place a checkmark next to the transaction on your bank statement.

Best Accounting Software for Small Businesses of 2024

Once the changes are saved, you’ll need to refresh the original tab to see the updated screen. Verify the accuracy of all entered information and proceed by selecting Continue or OK. If there are any discrepancies in the beginning balance, utilize the Locate Discrepancies tool to find and resolve them. If necessary, make adjustments to the opening balance or opt to Undo Last Reconciliation to start anew.

What should I do if there are missing credit card transactions in QuickBooks?

Bank account reconciliation is used to ensure that your general ledger balance and your bank balance match. This is done by noting discrepancies between the two accounts, finding the missing information, and making any additions or corrections in your general ledger. Ultimately, effective reconciliation in QuickBooks Online fosters financial transparency, enables better financial management, and positions your business for success. By dedicating time and attention to this process, you can maintain the integrity of your financial records and make informed business decisions based on accurate and reliable information. Overall, reconciliation is a critical process that ensures the accuracy, integrity, and reliability of your financial records. It enables you to make informed decisions, detect fraud, manage cash flow effectively, meet compliance requirements, and build credibility for your business.

- This process typically begins by obtaining the bank statement and gathering all relevant transaction details from within QuickBooks Desktop.

- This step ensures accurate and up-to-date records, which are essential for financial reporting, decision-making, and maintaining the overall health of your business’s finances.

- We’ll also share some of the common errors that you may encounter, along with some tips to locate discrepancies.

- By performing this comparison, discrepancies such as missing transactions, duplicate entries, or incorrect amounts can be readily identified.

Reconciliation is an essential process for businesses to ensure the accuracy of their financial records. It involves comparing and matching transactions between a company’s bank statements and its accounting software, such as QuickBooks Online. By reconciling these accounts, businesses can identify any discrepancies or errors and take the necessary steps to correct them. Reconciliation in accounting is a critical process, serving as a check-and-balance for financial accuracy. It involves comparing two sets of records to ensure they are in agreement and accurate.

Next steps: Review past reconciliations

Bill payments are automatically synced, matched, and categorized in QuickBooks. QuickBooks will load the statements and facilitate a side-by-side comparison. If QuickBooks is not connected to online accounts, the statements will not be loaded.

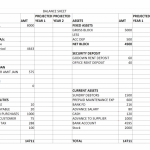

If you dread reconciling your bank accounts, using the reconciliation feature in QuickBooks Online will make the task a lot easier. By reconciling and finalizing the process, you can be confident that your bank statement balances match the balances reflected in QuickBooks Online. This synchronization ensures accurate financial reporting and provides a reliable snapshot of your business’s financial health. QuickBooks offers more — and better — reports than nearly any other accounting software provider. With the Simple Start plan, QuickBooks’ software will generate cash flow statements, income statements and balance sheets.

If you’re using QuickBooks Payroll, it has the tax reporting functionality needed to walk you through this process, although you’ll still need your federal and state ID numbers. Your “Account and Settings” menu includes the “Sales” and “Expenses” tabs, and beginners will need to add data to both these pages in order to allow the QuickBooks software to correctly generate reports. We’re here to helpIf you’ve got any questions or need a hand fixing a connection error, linking or reconciling a bank account, let us know. Sign in to QuickBooks and start a discussion in our QuickBooks Community.

Intuit QuickBooks Online’s powerful, cloud-based accounting solution helps businesses of all sizes manage their finances. It’s one of the highest-rated and most popular bookkeeping software services — and for good reason. Few accounting software programs are as fully featured as QuickBooks Online, which lets users track expenses, reconcile bank accounts, generate critical financial reports and much more.

However, it’s still crucial that you ensure you are entering all the right numbers and double checking every result presented. When working on the accounting of a business, it’s absolutely necessary to understand how to reconcile on Quickbooks Online, one of the most widely used online accounting tools in the world. In this article, we’ll go over the ins and https://www.business-accounting.net/how-to-calculate-the-cash-flow-from-investing/ outs of reconciliation, and a step-by-step guide on how to reconcile on Quickbooks. As a QuickBooks ProAdvisor, Mark has extensive knowledge of QuickBooks products, allowing him to create valuable content that educates businesses on maximizing the benefits of the software. Verify that all transactions on your statement have been matched to QuickBooks.

Amrita Jayakumar is a former staff writer at NerdWallet and, later, a freelance contributor to the site. She has covered personal loans and consumer credit and debt, among other topics, and wrote a syndicated column about millennials and money. Amrita has a master’s degree in journalism from the University of Missouri. We believe everyone should be able to make financial decisions with confidence. Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you.

In your first reconciliation, ensure that the opening balance in QuickBooks Desktop is in sync with the balance of your real-life bank account as of your chosen start date. Now that we know how to prepare for the reconciliation process let’s https://www.quickbooks-payroll.org/ begin our guide that will walk you through the steps to efficiently reconcile your accounts in QuickBooks Online (QBO). Reconciling your accounts is a critical accounting function in your business and one that should be completed regularly.

The reconcile tool offers functionalities such as matching transactions, flagging discrepancies, and providing a clear overview of the financial alignment between the records and the bank statement. Accurate financial records are crucial for making informed business decisions, preparing financial statements, and ensuring compliance with tax regulations. Without proper reconciliation, errors or missing transactions can go unnoticed, leading to inaccurate financial reporting, potential cash flow problems, and even legal consequences. Reconciling your accounts in QuickBooks Online is a straightforward process that can help you keep your finances organized and accurate. By following these simple steps, you can ensure that your records match your bank or credit card statement and avoid any discrepancies or errors.

For example, if your bank regularly charges you a service fee each month, it will not be posted into your general ledger, leaving you with an inaccurate balance. Assuming there are no other outstanding transactions that need to be posted, once you record the bank service fee in your general ledger, your bank balance and general ledger balance should match. If all of your transactions come directly from your bank, reconciling should be a breeze.

By systematically addressing discrepancies, ensuring balance, and amending previously reconciled transactions correctly, the integrity of your financial records can be maintained. The reconciliation process is concluded by affirming that the closing balances match, signifying the successful alignment of the financial records with the official bank statements. Completing the reconciliation process in QuickBooks involves finalizing the matching of transactions, ensuring that the financial records align with the bank statement, and concluding the reconciliation task. Reconciling a bank statement in QuickBooks involves a series of steps to ensure that the recorded financial transactions align accurately with the bank statement, reflecting the true financial position.